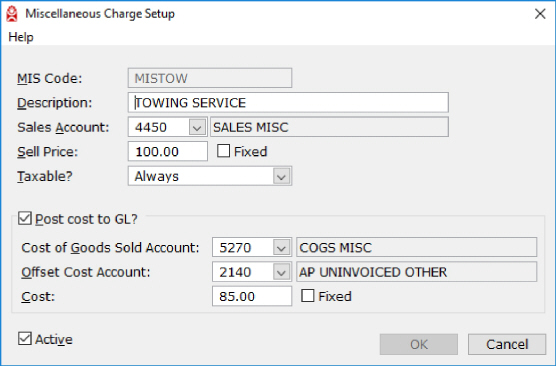

A scenario for the use of a miscellaneous charge with a cost is when a customer needs to have a vehicle towed to your business. You contact a company to tow the vehicle for the client. When the vehicle is delivered, the tow truck driver hands you an invoice for the towing service. The counterman has to include the additional towing service on the customer's order. The counterman is able to enter the MISTOW in Order Entry to charge the expense of the towing service to the client's order.

Here is an example of the MISTOW charge entry in the general ledger.

DESCRIPTION |

ACCOUNT |

DEBIT |

CREDIT |

Sales Misc |

4450 |

|

100.00 |

Sales Tax |

2310 |

|

10.00 |

COGS Misc |

5270 |

85.00 |

|

AP Uninvoiced Other |

2140 |

|

85.00 |

Accounts Receivable |

1210 |

110.00 |

|

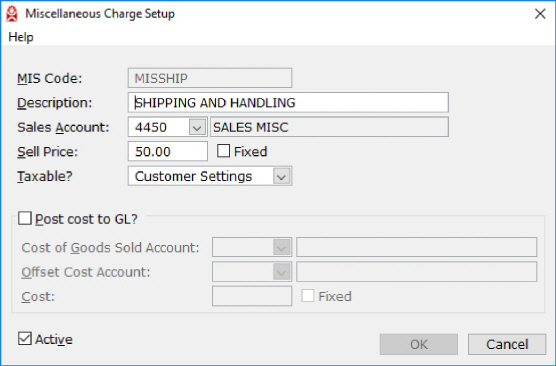

A scenario for use of a shipping and handling miscellaneous charge is when including additional shipping charges on an invoice. A customer orders a part they need shipped overnight. The counterman should charge the additional shipping amount. Using the MISSHIP code in Order Entry he is now able charge the customer for the additional amount for overnight shipping.

Here is an example of the MISSHIP charge entry in the general ledger.

DESCRIPTION |

ACCOUNT |

DEBIT |

CREDIT |

Sales Misc |

4450 |

|

50.00 |

Accounts Receivable |

1210 |

50.00 |

|